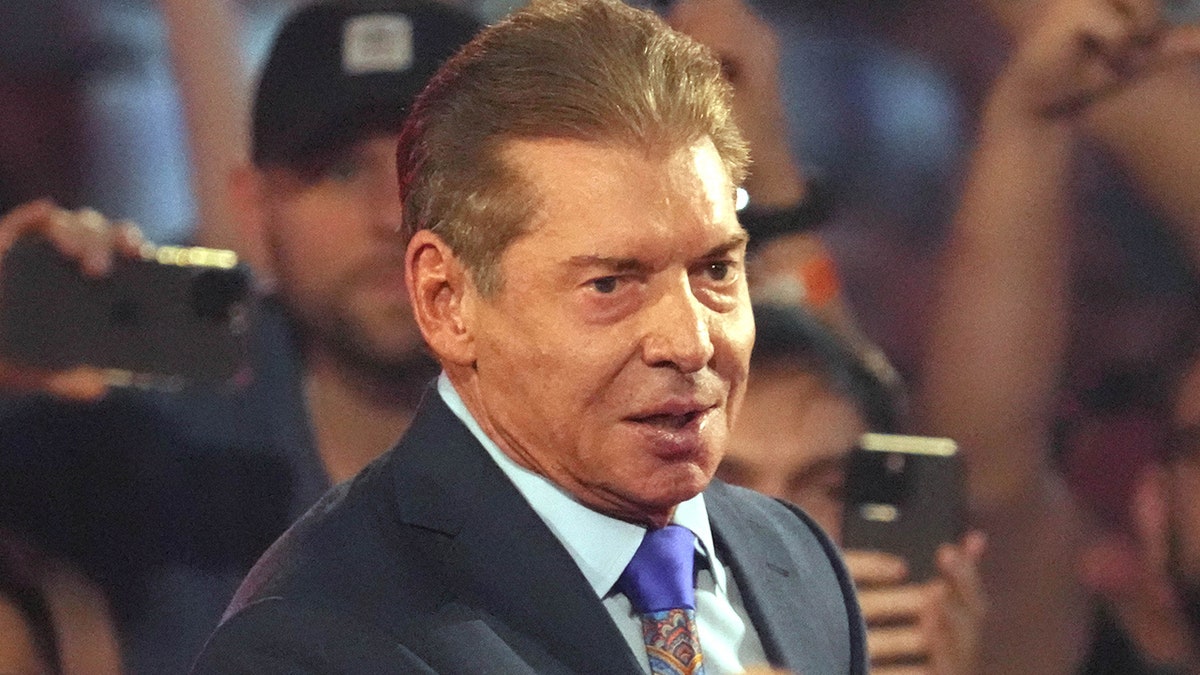

A former lawyer for pro-wrestling impresario Vince McMahon was wrong to withhold some documents from a federal grand jury as it investigated how the former WWE boss handled multimillion-dollar settlement agreements with two female employees who accused him of sexual abuse, a federal appeals court ruled Monday.

Three judges on the 2nd U.S. Court of Appeals in New York upheld a lower court ruling that said the documents were not protected by attorney-client privilege because of an exception for “crime or fraud.”

The appeals court said the lower court judge found prosecutors had reasonable grounds to believe that McMahon and his lawyer illegally “circumvented” the WWE’s internal controls and created false records when they concealed the employees’ claims and settlement agreements from the company, and that they made false and misleading statements to the company’s auditors — even though McMahon paid the settlements with funds that did not come from the company.

The appellate panel said that while McMahon’s lawyer submitted many materials in response to a grand jury subpoena, they also submitted a log of 208 documents that were being withheld under assertions of attorney-client privilege.

Vince McMahon attends the WrestleMania 29 Press Conference at Radio City Music Hall on April 4, 2013 in New York City. (Eugene Gologursky/WireImage)

VINCE MCMAHON ACCUSER AGREES TO PAUSE SEXUAL ABUSE LAWSUIT AGAINST FORMER WWE BOSS

Though the identities of the parties were not disclosed in the appeals court opinion, a person familiar with the matter confirmed the unnamed “former Chief Executive Officer of a “publicly traded company” was McMahon. The person insisted on anonymity to discuss details that have not been made public.

The status of the grand jury investigation was not immediately clear. The U.S. attorney’s office in Manhattan has declined to comment when asked about the investigation, which it has not publicly disclosed.

Representatives for McMahon, who has denied wrongdoing, said they had no immediate comment on the court ruling. McMahon has previously suggested that he was no longer under investigation.

In January, McMahon said in a statement that “nearly three years of investigation by different governmental agencies” into his actions had ended. The statement came as the federal Securities and Exchange Commission announced it had settled charges against McMahon over his failure to disclose the settlement agreements with the two now-former employees to WWE officials.

“In the end, there was never anything more to this than minor accounting errors with regard to some personal payments that I made several years ago while I was CEO of WWE,” the statement said. “I’m thrilled that I can now put all this behind me.”

Apr 3, 2022; Arlington, TX, USA; Then-WWE owner Vince McMahon during WrestleMania at AT&T Stadium. (Joe Camporeale-USA TODAY Sports)

VINCE MCMAHON CALLS SEXUAL MISCONDUCT ALLEGATIONS AGAINST HIM ‘PURE FICTION’

The appeals court, however, said in Monday’s ruling that the case “concerns proceedings currently before a grand jury. At present, no indictments have been issued.”

The opinion disclosed some new details of the grand jury probe.

Representatives for one of the former employees who got a settlement agreement from McMahon, Janel Grant, declined to comment Monday.

McMahon resigned from WWE’s parent company in January 2024 after Grant filed a federal lawsuit accusing him and another former executive of serious sexual misconduct. At the time, McMahon stepped down from his position as executive chair of the board of directors at WWE’s parent company, TKO Group Holdings. He continued to deny wrongdoing following the filing of the lawsuit.

McMahon stepped down as WWE’s CEO in 2022 amid a company investigation into allegations that match those in the lawsuit.

Grant has said she was pressured into leaving her job with the WWE and signing a $3 million nondisclosure agreement.

Apr 3, 2022; Arlington, TX, USA; WWE owner Vince McMahon enters the arena during WrestleMania at AT&T Stadium. (Joe Camporeale-USA TODAY Sports)

VINCE MCMAHON CHASTISES UPCOMING NETFLIX DOCUSERIES AHEAD OF RELEASE, ALLEGES ‘EDITING TRICKS’ DISTORT STORY

The lawsuit, which alleges sexual battery and trafficking, also seeks to have the agreement declared invalid, saying McMahon breached the deal by giving her $1 million and failing to pay the rest.

The $3 million settlement is mentioned in Monday’s appellate court ruling, along with another $7.5 million settlement McMahon made with another former employee.

The Associated Press does not normally name people who make sexual assault allegations unless they come forward publicly, which Grant did.

Prosecutors served subpoenas on McMahon’s lawyer, who is unnamed in court documents, and the attorney’s firm in September 2023, seeking all communications between McMahon, his attorney and the law firm regarding the two former employees, according to the appellate court. The lawyer helped McMahon negotiate the settlements, the court said.

CLICK HERE TO GET THE FOX NEWS APP

When the lawyer withheld some of the documents claiming attorney-client privilege, prosecutors asked the lower court to compel production of the records — leading to the appeal decided Monday.

The appellate judges wrote, “Because the settlement agreements resolving the Victims’ claims were ‘structured and negotiated … to keep them hidden from (the Company),’ the district court found that ’all communications about the claims and settlement agreements were made in furtherance of the criminal scheme to keep (the Company) and its auditors unaware of the allegations.’”